10 years ago, in September 2014, The Royal Mint began selling investment grade bullion directly to the public at prices linked to the live metal spot price.

At the time a spokesperson from The Royal Mint said of the decision to launch a 24/7 live price trading platform ‘Consumers have been deterred from taking the plunge because of the perceived barriers to purchasing precious metal’ such as finding a trusted dealer and arranging storage. The Royal Mint, with our 1,100 year history, our purpose-built vault, and our status as 100% owned by His Majesty’s Treasury, was well placed to meet this need.

Initial Offering

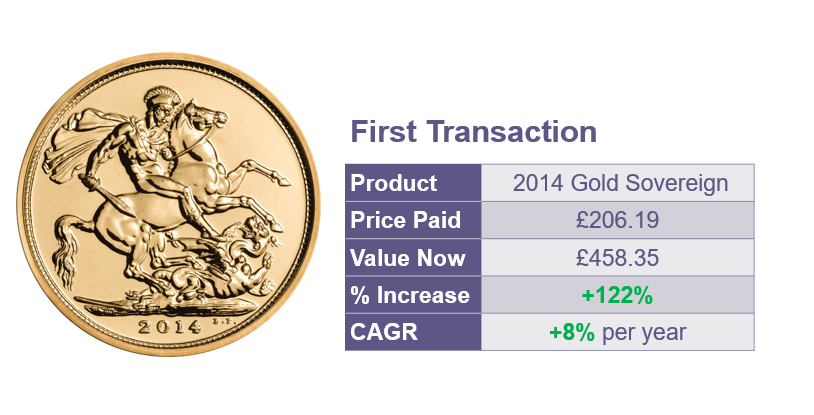

Initially the products investors could choose from were relatively limited; the website listed gold Full Sovereigns, the full range of gold Britannias, 1oz silver Britannias, and 1oz gold and silver Lunar Year of the Horse coins. Metal prices were also relatively low compared to today, with gold below £800/oz and silver around £11/oz!

Prices and increases are compared to the LBMA PM Fix of 12th September 2024, and are inclusive of the buy premium.

Remarkably, 8% of customers who purchased bullion from The Royal Mint in our first year of selling bullion online, are still active customers today, having also transacted within the past 12 months! This continued business over such a long stretch of time is thanks to the service we offer customers, including via our Wealth Management team.

Expansion of Products and Services

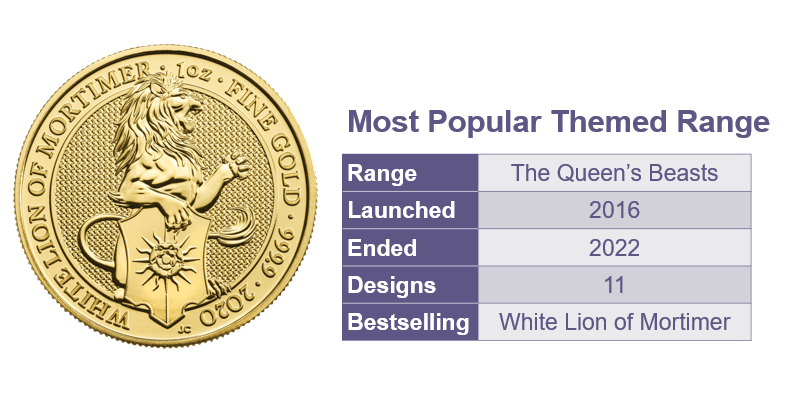

As global spot prices rose, and investors’ needs changed, we broadened our range of products to ensure that precious metals ownership was more accessible and convenient than ever before. Since 2014 the website has listed over 600 different products linked to live metal prices. In 2015, less than 10 months after we launched the trading platform, we launched DigiGold (then known as Signature Gold) empowering customers to enjoy the flexibility of owning fractions of larger bars at the lowest premiums. In the same year, we also began selling bullion bars. The following year, in 2016, we launched our Gold for Pensions accounts, enabling UK SIPP and SSAS pension holders to add physical gold bullion to their pensions and store them in our high-security vault. In 2021 we expanded this service to also facilitate US Individual Retirement Accounts. In 2017 we launched our first platinum bullion coins. The first such coin featured the Lion of England from the popular The Queen’s Beasts bullion range.

‘Most Popular’ refers to the number of individual customers who purchased from this range via our website. ‘Bestselling’ refers to the total number of units of a particular design sold via our website.

While we’d always been happy to buy back any bullion stored in our vault, by 2018 we’d made the necessary changes to processes and policies to be able to buy coins and bars that investors were storing in their homes or elsewhere – our buy back service was launched. In 2019 we began selling 1g gold bars designed to be given as Christmas gifts, and this gifting range now includes precious and valuable gold bars perfect for birthdays, graduations, Diwali and Eid!

Trading through Turbulent Times

2020 saw our separate bullion trading platform merge onto royalmint.com, giving customers the opportunity to browse the entire collection of products from The Royal Mint and manage their purchases through a single royalmint.com account.

As the coronavirus pandemic hit, demand for precious metals surged as investors sought out safe-haven assets in unprecedented numbers, but our website continued to operate throughout.

‘Best Selling Product’ refers to the total number of units of a particular product sold via our website.

2022 was a year of seismic royal events. We celebrated the Platinum Jubilee with special commemorative sleeves for our 1/10oz Platinum Bullion Britannia coins, and our created a special record breaking 2kg platinum Britannia. However later that year saw the sad passing of Her Late Majesty Queen Elizabeth II. The accession of King Charles III to the throne marked the biggest change to coinage since decimalisation, and the first new monarch to appear on UK coins in 70 years. In addition to a new line of products celebrating the new king, we developed our investment calculator in 2023 to help customers discover a range of options available based on their budgets.

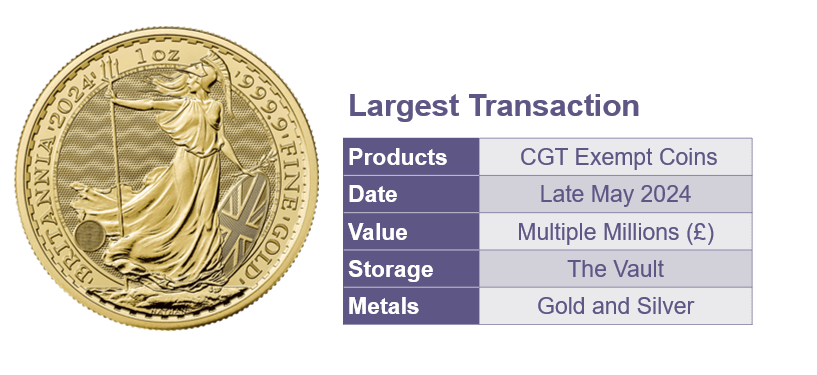

2024 was the biggest year for elections in global history. More people around the world headed to the polls than ever before, and this brought economic and geopolitical uncertainty. Among many other places, elections took place in India, the EU, the UK and are due to take place in the USA in November. Demand for tax-efficient, and safe-haven investments remained elevated.

Earlier this year (2024), we also began to facilitate trading accounts for businesses wishing to buy, store, and sell precious metals.

The Changing Landscape of Precious Metals Investing

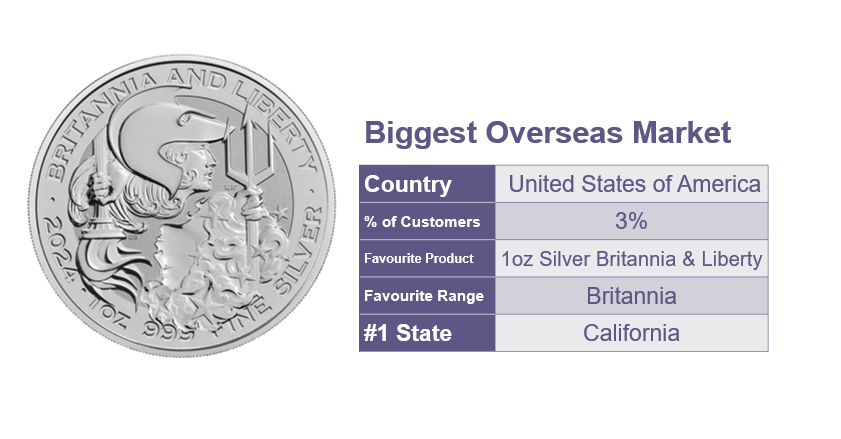

In our 10 years of selling bullion online, we’ve served over 117,000 customers in 116 different states and territories around the world, and overseas customers have formed an increasing proportion of our database over the last 5 years.

We’re committed to introducing precious metals to a wider range of female investors, who just 5 years ago made up just 10% of our database. Since 2019/20, the number of women buying bullion from our website has grown almost 670%. This remarkable growth reveals the opportunities that still exist in the market, and continued growth is likely to lead to higher demand.

Millennials (those born between 1981 and 1996) are now overrepresented in our database versus the UK population – a sign that this generation are perhaps more likely to invest in precious metals, which could impact demand as they reach senior positions and have larger disposable incomes.

The coronavirus pandemic and the inflation that followed appear to have changed the investment for good. Our own data and anecdotal evidence suggest that precious metals are now much more likely to be considered as part of an investment portfolio than in the pre-pandemic environment. The Royal Mint will continue to ensure that precious metals investing is as accessible to as broad a range of people as possible, and we’ll continue to adapt to new technologies and changing investor requirements.

We look forward to helping you meet your precious metals investment goals over the next 10 years and beyond!

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.